Remote Working - Know Your Tax Risks

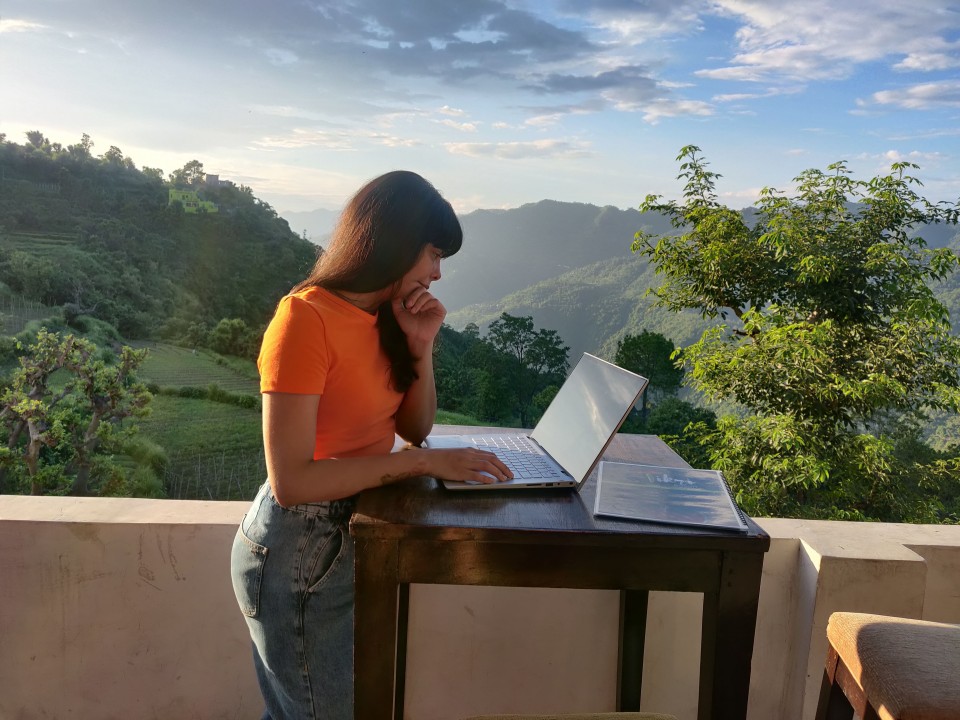

Remote working became the norm during the height of the pandemic, and since then employers seem to be far more willing to allow staff to work from home. This includes employers recognising that staff can complete their work from a different country. Prior to the pandemic we might provide tax advice to one or two persons per month who worked remotely for offshore employers. We are now providing tax advice to at least one new client per week who lives in New Zealand and works for a foreign employer.

While the logistical aspect of working remotely has vastly improved, people are still largely unaware of the tax implications for such an arrangement. While tax should never be a driving force for decisions, seeking tax advice in advance is always recommended in order to allow time to structure things in a tax efficient manner and avoid double taxation as much as possible.

The tax implications of working in New Zealand for a foreign employer will differ depending on the facts of the situation. Someone living and working in New Zealand, albeit for a foreign employer, should expect to pay some if not all of their tax in New Zealand. This can lead to a cashflow issue for them if their employer continues to withhold tax in the home country. If someone has moved to New Zealand permanently and spends all of their time here it is highly likely that the majority of their income will be taxed in New Zealand, if not all of it. Certainly under domestic law this would be the case.

New Zealand has a full network of double tax agreements with all our major trading partners. A double tax agreement can provide relief against double tax in certain situations. The application of the double tax agreement will provide which country has primary taxing rights for the income In some circumstances, income tax will need to be paid in both countries, but a foreign tax credit is generally allowed to recognise tax paid in the country that gad primary taxing rights.

Where an employee who travels and works in both countries, it is possible that they are required to allocate the income to the country in which they are working i.e. this could mean determining how many days you spend in each country, and then splitting your income between the two. Alternatively, all of the income may be subject to tax in one of the countries if you can keep your presence in that country under 183 days. If your employer has a permanent establishment in one country, then that can change which country has primary taxing rights. We have written more about the tax impications for the company and whether or not it may have a permanent establishment in this article.

The above is the case regardless of whether or not you repatriate the funds to New Zealand. In fact, if the funds remain offshore you could also be subject to other taxing provisions such as the financial arrangement rules.

An employee will also need to consider how they deal with their taxes in New Zealand from a practical perspective. As they are an employee their employer would generally be required to withhold PAYE. This is not going to be easy if the employer is an offshore employer and is not familiar with the New Zealand tax system. Therefore, the employee could be required to register as an IR56 tax payer. This is the case if the employee is classified as a New Zealand based employee of an offshore entity. There are also other limited circumstances in which a person may be an IR56 tax payer.

It is usually the case that we are not instructed to act until the individual believes there is a problem, or Inland Revenue have asked questions. In such a case, it will be necessary to “correct” your previous tax position. This involves a voluntary disclosure to Inland Revenue. A voluntary disclosure is a legal process which allows someone to tell Inland Revenue of previous mistakes in their tax position they have previously taken. The benefit of a voluntary disclosure is that low-end shortfall penalties can be reduced to zero for a pre-audit notification voluntary disclosure. For any incorrectly withheld tax in the home country it will be necessary to work with your home country revenue department in order to obtain a tax refund. We work with a number of specialists for offshore taxes who are able to assist with this aspect.

It is important to note that it is not just the monetary income that is subject to tax in New Zealand but any remuneration benefits provided as part of your employment. This often includes pension contributions and any other benefits such as medical and life insurance, etc. Rather than making these subject to FBT these can be grossed up as income and then tax paid on those amounts. This does lead to additional tax because you are being taxed on those products. This can be the case even if those benefits would be tax free in the home country. As such,, individual tax advice is always required in order to ascertain the exact taxing implications in New Zealand.

Employee share schemes are subject to tax in New Zealand and this tax is nearly always different to the tax regime of the home country. These can create significant tax implications and complications, so individual tax advice should always be sought if you are part of an employee share scheme whether or not you have shares that are vesting or have vested.

Self-employed individuals who are contracting offshore or to previous employers offshore will have slightly different taxing implications, but again, should expect to return and pay tax in New Zealand at least on a proportion of that income if not in its entirety.

If you or someone you know is working for a foreign employer or considering doing so, please get in touch to discuss and seek specialist tax advice in relation to your personal circumstances so that you can prepare and are not hit with a nasty tax bill.

The above is intended for informational purposes only and should not replace specific tax advice. For personalised advice on all tax issues please contact Julia Johnston at Saunders & Co